Permit’s be honest—buying an insurance plan Option isn’t everyone’s concept of a great time. But when you’ve ever dealt with a major car incident, a flooded basement, or a overall health crisis, you know how important it truly is. Even now, the phrase "insurance policy Remedy" Appears somewhat… technical, ideal? But at its core, it just suggests acquiring the appropriate sort of security for yourself, your things, and your satisfaction. It’s not about finding a approach off a shelf. It’s about crafting a security Web that truly is effective in your unique lifestyle.

You could be questioning: What can make an insurance plan solution distinct from just "coverage"? Great query. Think of it like setting up your own personal pizza instead of ordering the common pepperoni. An insurance coverage Resolution is personalized. It combines the correct types of protection—car, property, well being, life, maybe even pet or travel insurance coverage—right into a offer that satisfies your requirements. The times of 1-dimension-fits-all insurance policies are driving us. Now, it’s all about personalization, and honestly, that’s a great thing.

Now Allow’s communicate solutions. There are many. Conventional insurers, on the net-only providers, brokers, insurtech startups—the record goes on. So How does one even start to settle on? The important thing lies in being familiar with what you're actually on the lookout for. Have you been attempting to safeguard your online business from liability? Your family from unpredicted health-related expenses? Your vehicle from that wild hailstorm that will come each and every spring? The right insurance Remedy commences with the appropriate queries.

At any time listened to someone say, "I don’t need to have insurance policies—I’m thorough"? That’s like indicating you don’t require a seatbelt because you’re a fantastic driver. Daily life throws curveballs. It’s not about if some thing will materialize, but when. A good coverage Remedy offers you a parachute before you even know you’re falling. It’s the quiet hero in the track record, ready when things go south.

The Best Strategy To Use For Insurance Solution

Permit’s break down what an extensive insurance policies solution could possibly look like. Envision you’re a freelancer. You work from home, push your own vehicle for conferences, and perhaps sell merchandise on line. You’ll need to have wellness insurance coverage, property or renters insurance, vehicle protection, perhaps even professional liability or cyber insurance plan. A tailor-made insurance policies solution bundles everything right into a neat offer—and possibly will save you funds and tension.

Permit’s break down what an extensive insurance policies solution could possibly look like. Envision you’re a freelancer. You work from home, push your own vehicle for conferences, and perhaps sell merchandise on line. You’ll need to have wellness insurance coverage, property or renters insurance, vehicle protection, perhaps even professional liability or cyber insurance plan. A tailor-made insurance policies solution bundles everything right into a neat offer—and possibly will save you funds and tension.Everyone knows budgets are restricted. But skipping insurance isn’t saving—it’s gambling. The proper insurance Alternative fits into your spending plan even though nevertheless providing you with genuine defense. It’s not about paying for bells and whistles you don’t want. It’s about selecting neatly. A very good service provider will help you strip absent extras and target what truly matters for the Way of life.

Now, Allow’s take a look at technological know-how. Fashionable insurance plan remedies are run by facts, AI, and customer-centric platforms. That means fewer forms, faster approvals, and instantaneous entry to your paperwork. Some applications even let you tweak your plan in true-time. Forgot to include your new laptop computer to your renter’s protection? Done in a faucet. These tools are making coverage more person-pleasant than previously.

We reside in a planet in which we monitor our ways, check our paying, and also time our sleep. So why wouldn’t we wish our insurance coverage to get equally as intelligent? A contemporary insurance Resolution learns from you. Some even give discounts according to Secure driving or nutritious routines. It’s not only safety—it’s empowerment. Your coverage ought to work for you, not one other way all around.

Below’s a standard suffering stage: promises. No-one likes dealing with them. But the ideal insurance policies Answer tends to make that procedure smooth. Some platforms now use video clip proof, direct deposit, and automated verification to hurry things up. The faster you receives a commission, the faster existence goes again to ordinary. That’s what it’s all about—resilience, not simply coverage.

Have you ever attempted looking at an insurance policy plan entrance to again? It’s like decoding historic scrolls. But a superb insurance plan Resolution demystifies the jargon. It should reveal issues in basic English, not legalese. You are worthy of to know Anything you’re purchasing. And if you don’t, that’s a red flag. Clarity should really generally appear normal.

Permit’s mention everyday living phases. The insurance Answer you may need at 25 is totally various from what you would like at 50. If you're solitary, you would possibly concentrate on renters and wellness insurance plan. Add a wife or husband, possibly you need existence insurance plan. Young ones? Believe schooling and overall health procedures. Retirement? Now you’re looking at extended-time period treatment or supplemental healthcare strategies. Insurance grows with you—if you let it.

Then there’s business enterprise. Irrespective of whether you’re launching a startup or functioning a family members enterprise, professional insurance is actually a beast of its have. Liability, assets, cyber hazard, worker protection—the record is very long. A sturdy insurance plan Resolution Here's much more than a coverage. It’s chance management, upcoming scheduling, and satisfaction wrapped into a single. Consider it as your enterprise’s safety harness.

Let’s not neglect travel. From missed flights to lost luggage to abroad emergencies, journey insurance policies frequently will get disregarded. But a whole insurance coverage Answer consists of these times. It’s not about paranoia—it’s about independence. Figuring out you are included lets you rest and revel in your vacation. And isn’t that the point of traveling in the first place?

You know very well what’s Odd? Individuals will insure their cell phone before they insure their wellness. That’s the planet we live in. But an effective insurance plan Resolution prioritizes what genuinely matters. Confident, guarding your gizmos is excellent—but what about you? How about All your family members? What regarding your long term? That’s wherever the worth certainly lies.

The Ultimate Guide To Insurance Solution

Insurance Solution Fundamentals Explained

Allow’s dive into customization. The most effective insurance solution allows you select deductibles, include-on coverages, payment schedules, and much more. It’s like building an automobile with exactly the functions you want—no additional, no fewer. Want flood coverage but not earthquake? Need to have larger limitations for jewellery although not furniture? It’s all doable. You’re in control, not the insurance provider.

A word about brokers: they’re not extinct, and they can in fact be your secret weapon. An incredible broker can craft an coverage Alternative which you might not obtain all by yourself. They know the marketplace, they know the loopholes, plus they know how to get you the very best offer. It’s like possessing a GPS within the maze of insurance plan options.

What about bundling? You’ve probably viewed the adverts. But it surely’s greater than a gimmick. Bundling multiple insurance policies into a single insurance plan Remedy can in fact reduce rates and streamline promises. One particular supplier, one particular Get in touch with, one Continue reading Invoice—it’s simplicity in a fancy planet. And who doesn’t enjoy saving time and money?

Allow’s tackle the elephant during the space: belief. Insurance policy firms haven’t always had the best popularity. But transparency, on line critiques, and buyer-first platforms are altering the sport. A trustworthy insurance solution is developed on open communication, reasonable pricing, and quick response periods. If you feel like just An additional amount, it’s the perfect time to glance elsewhere.

Sustainability is creeping into insurance policy, way too. Inexperienced automobile policies, weather-mindful property protection, and insurers who invest in moral companies—it’s all Portion of another-gen insurance policies Alternative. It’s not nearly shielding your earth. It’s about safeguarding *the* environment. That sort of alignment feels great and does great.

Finally, Permit’s provide it residence. An coverage solution isn’t just paperwork—it’s a promise. A promise that when existence throws a thing huge, you’re not on your own. Regardless of whether it’s a fender-bender, a home hearth, a damaged bone, or some thing it is possible to’t even consider yet, you’ve bought a prepare. And using a system? That’s the last word satisfaction.

Talia Balsam Then & Now!

Talia Balsam Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Brooke Shields Then & Now!

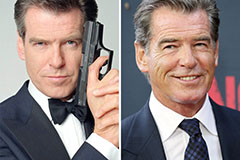

Brooke Shields Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!